With QuickBooks accounting software, you can manage all of your business's finances in one convenient platform.

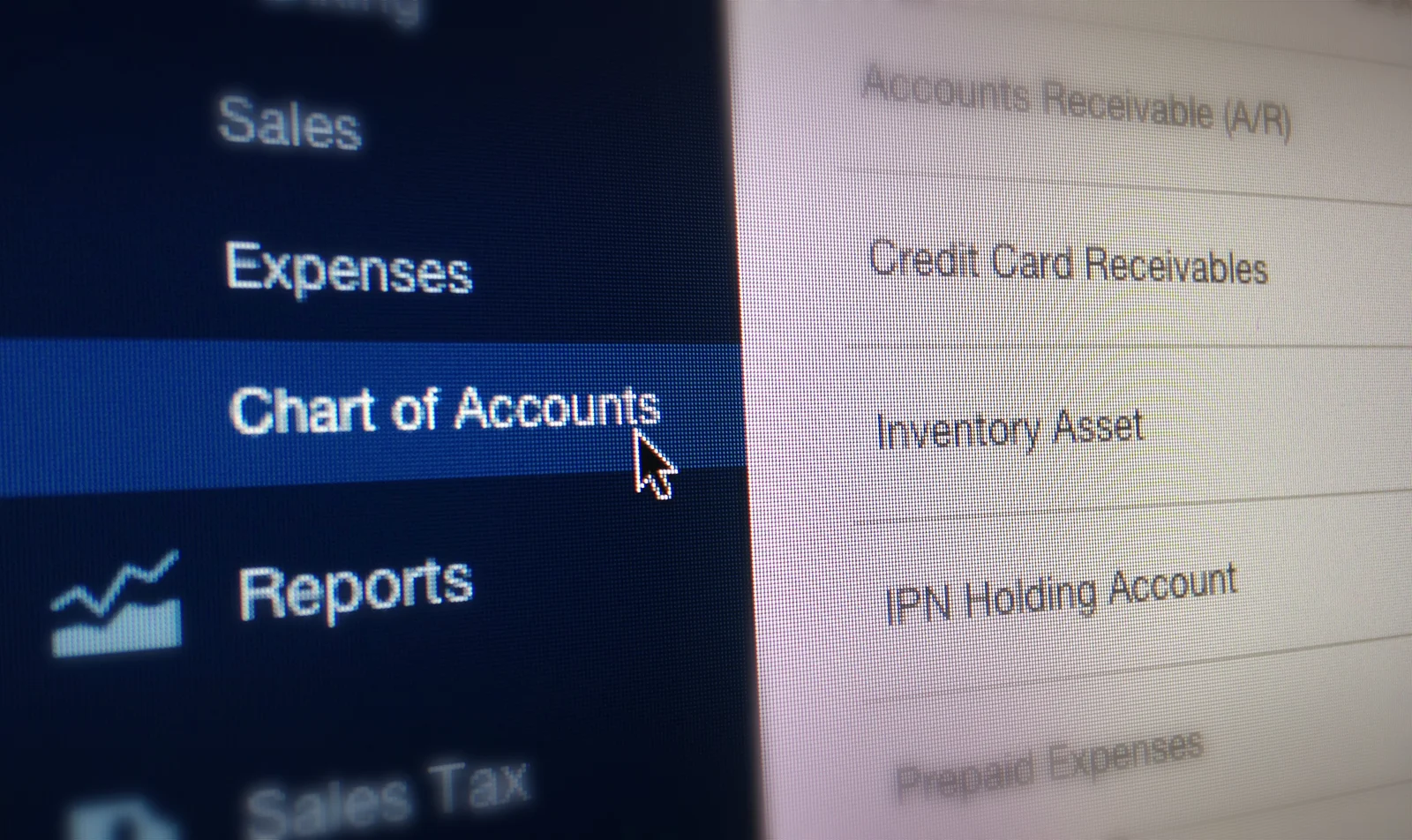

Chart of Accounts management is one of the many features QuickBooks offers to help ensure your company's financial health. The Chart of Accounts contains a complete list of your business's accounts and their balances. You use it to track how much money your company has, how much money it owes, how much money is coming in, and how much money is going out.

Implementing the Chart of Accounts provides invaluable benefits:

- Clearly and accurately evaluate your transaction data by viewing all of your accounts in one place

- Keep your finances organized and up-to-date

- Better understand your economic status so you can keep focusing on the day-to-day demands of your company

Through the Chart of Accounts feature, you can add, modify, and merge accounts, as well as create sub-accounts. You can also perform common tasks and run reports directly from the chart of accounts window. To select from a list of common tasks, click the Activities drop-down arrow. To select from a list of available reports, click the Reports drop-down arrow.

As you set up your Chart of Accounts, you will discover the abundant advantages QuickBooks provides to simplify your finances:

- A personalized template is generated to ideally suit your company's needs

- User-friendly navigation goes beyond initial programming to create easy reviewing, editing, and categorizing of your accounts

- Manage your overall history or transaction details with just a few clicks at any time.

- Keep track of monies from anywhere you are with financial data synced across all of your devices

- Add as many accounts as you need, whenever you desire, to stay on top of your most fundamental records more closely

The structure of your company’s Chart of Accounts should not be taken lightly. Small business owners should think through this first to create a structure that allows for the best internal management reporting (including matching with your budget format for seamless budget vs actual tracking) while also providing a structure that meets the needs of your CPA for tax filing.

FOSS Business Solutions has helped many small businesses re-map their Chart of Accounts in order to get the most out of QuickBooks reporting for financial analysis. You may want to consider having a professional assist you with QuickBooks set up and programming.

Along with this Chart of Accounts utility, QuickBooks also presents business owners with useful features such as Balance Sheets, Profit and Loss Statements, Accounts Receivable and Payable Reports, Cash Flow Statements, and many more. Stay tuned for more details and best practices on these features.