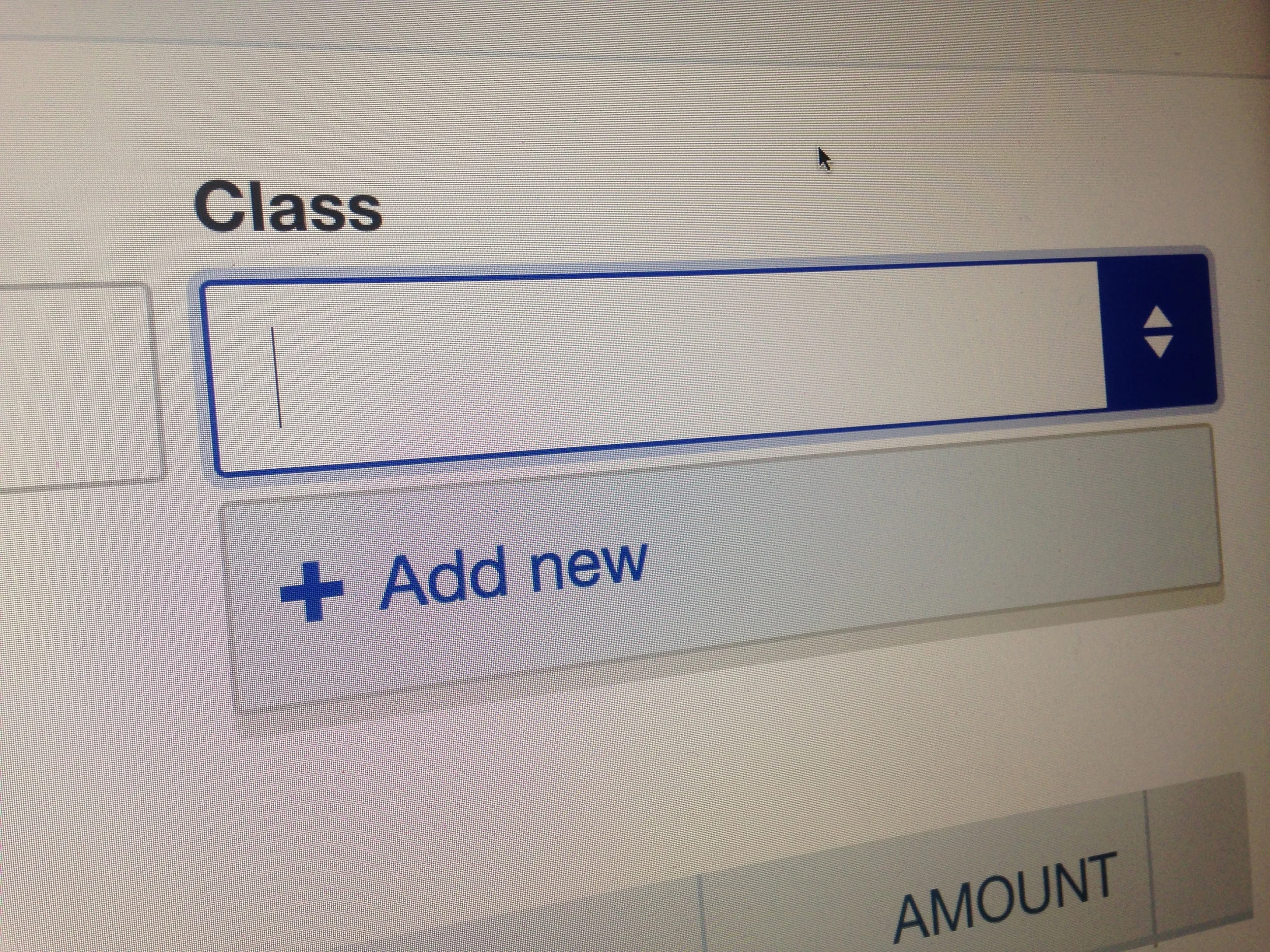

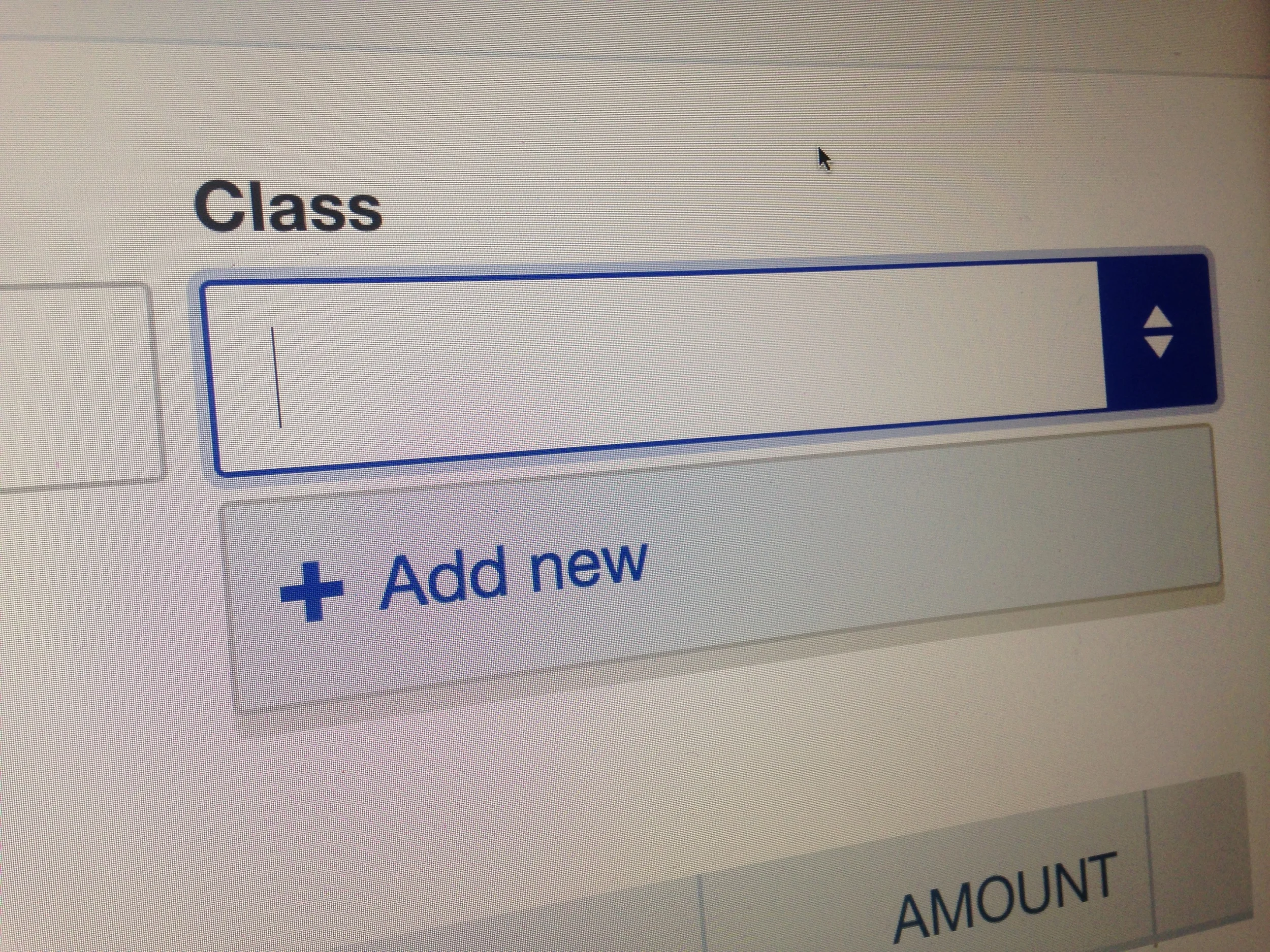

Using the class tracking feature provided by QuickBooks allows small business owners to organize transactions into classes, or categories, depending on the demands of the business and the areas that should be tracked.

The software lets you sort by custom groups that fit your needs, such as by location, department, enterprise, client, etc., and provide meaningful reporting for decision-making. Attorneys may choose to assign their classes by cases or areas of practice, for example, while merchants may sort by store location or type of sale.

Classifying transactions by financial functionality offers several vital professional benefits:

- Observe data and identify spending patterns by breaking down various financial segments

- Recognize the allocation of incoming and outgoing funds by function or department

- Create profitability reports by Class to make educated decisions

- Analyze performance of Class groups and fluctuations over time

- Ensure the simplicity and accuracy of your records by keeping with a congruent theme for your classification and coding system

Taking advantage of the QuickBooks class tracking tool provides easy financial organization for any small business.